I constructed my credit score rating from scratch in 13 months and it didn’t value me a cent – my three steps to comply with

GIMME CREDIT I constructed my credit score rating from scratch in 13 months and it didn’t value me a cent – my three steps to comply with

YOUR credit score rating is an important quantity that may determine whether or not you’re authorised for a mortgage, can get an excellent deal on a automotive mortgage, or are capable of lease an condo.

In the beginning of 2022, I personally had no credit score rating.

2 I constructed my credit score rating from scratch in 13 months with out spending a cent Credit score: The US Solar

WHY A CREDIT SCORE IS IMPORTANT

A credit score rating is a quantity calculated by the three main credit score bureaus – Equifax, Experian, and TransUnion – to provide lenders a illustration of how financially accountable you’re.

Your rating is utilized by bank card corporations, mortgage suppliers, automotive leasers and different companies to find out how doubtless you’re to pay them again.

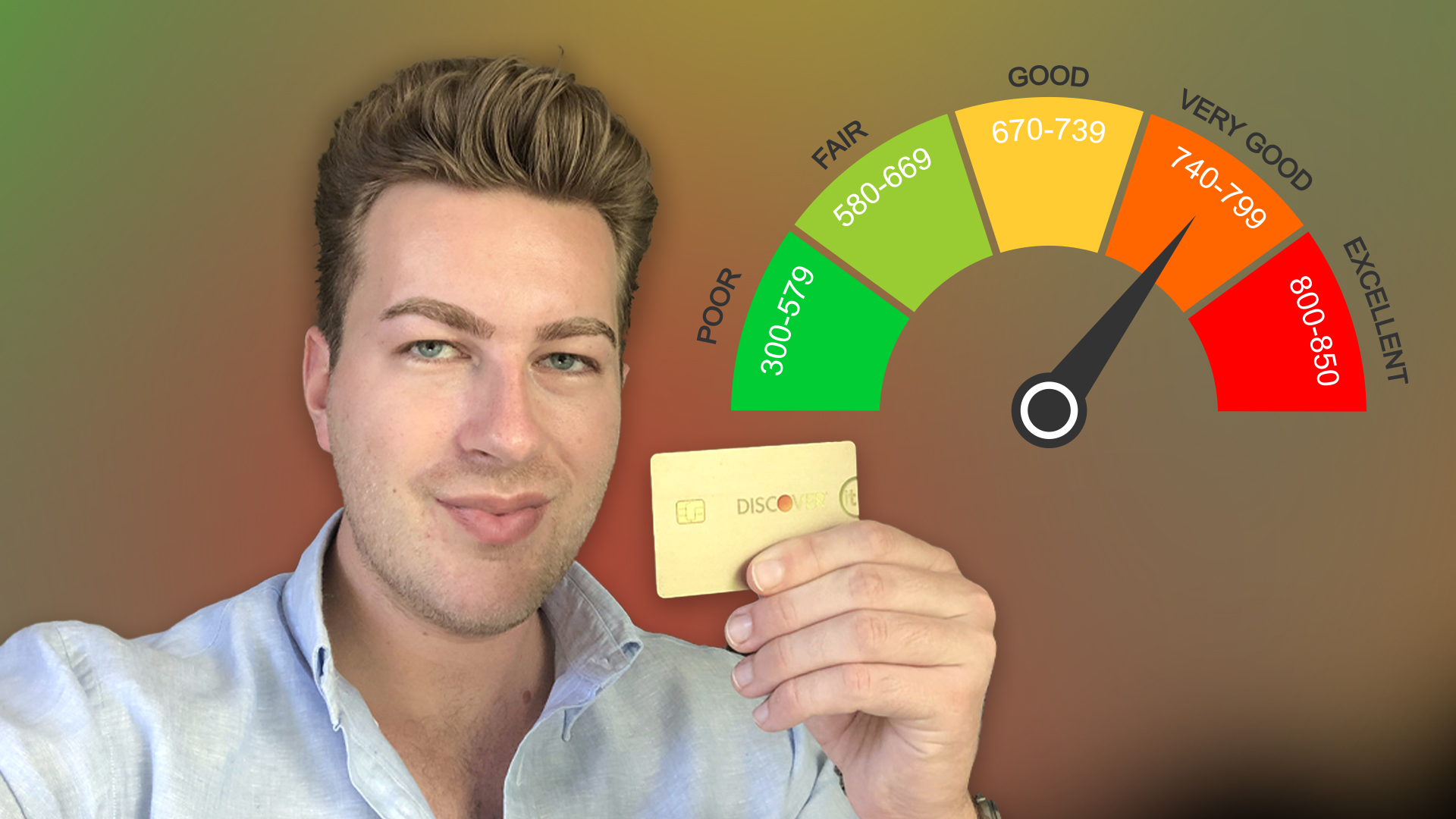

The bottom doable rating is 300 (poor) and the best is 850 (glorious).

A excessive rating offers you a greater likelihood of being accepted for these merchandise at a decrease rate of interest.

Having no rating in any respect cannot solely make it near-impossible to entry necessary monetary providers however it may well even lead to you being denied an utility to lease an condo.

I used to be one of many 45million Individuals residing with no credit score rating, in keeping with the Authorities Accountability Workplace, making my monetary life far more tough than essential.

As soon as I noticed how necessary this mysterious three-digit quantity can be to my monetary future, I made a decision to do one thing about it.

In 13 months, I went from having no credit score rating to a rating of 740, which is taken into account “excellent” by Experian.

The credit score bureaus have categorizations for various scores, and these vary from “poor” to “distinctive.”

2 Your credit score rating can vary from poor to distinctive Credit score: Experian

I’m going to share with you the precise steps I took to construct this rating with out spending a penny on bank card charges.

1. A SECURED CREDIT CARD

When you don’t have any credit score rating, or a really poor rating after years of debt, there’s doubtless just one sort of bank card you may get.

That’s a secured bank card, whereby the bank card firm takes a small deposit from you, which it then loans again to you as your credit score line.

This residue can be returned after getting proved that you’re a accountable person.

I took out the Uncover it bank card, which has zero charges and provides you cashback in your purchases.

To get the cardboard, I needed to put down a $200 deposit, which I acquired again after a number of months of accountable use.

USE IT TO YOUR ADVANTAGE

So how do you utilize your bank card responsibly?

One trick to enhancing your credit score rating is to solely spend one third of your credit score restrict.

In my case, my Uncover it credit score restrict was $200, so I solely spent $60 to $70 on the cardboard a month.

Then I paid off the steadiness in full, which is one other necessary step to constructing your rating and avoiding curiosity charges

2. A SECOND CREDIT CARD

After a number of months of utilizing my secured card, I used to be capable of get a mid-tier bank card.

Some examples of those playing cards embody:

I selected the Bilt Rewards card by Wells Fargo, which has zero charges.

These mid-tier bank cards will sometimes include rewards within the type of factors that you’ll accumulate with on a regular basis purchases.

Similar to the secured bank card, solely spend a 3rd of your credit score restrict, and pay it off in full.

These habits will see your rating enhance slowly however certainly.

Within the meantime, you can begin having fun with your rewards factors, which you’ll redeem on accommodations, flights, and extra.

3. RENT REPORTING

If you’re renting from a landlord, you should utilize your lease funds to construct up your credit score rating.

Nearly all renters can use a free app known as Piñata to confirm their lease funds.

The app stories to the three main credit score bureaus, and every on-time fee contributes to your rating because it signifies that you’re financially accountable.

Piñata additionally rewards customers with an in-app forex, Piñata Money, which will be redeemed for freebies at locations like Starbucks, Amazon, and Airbnb.

What’s extra, Piñata solely stories on-time, verified lease funds. So in the event you miss a month’s lease or make a late fee, that gained’t have a detrimental impact in your rating.

Piñata is presently the one free service of its sort that’s accessible to all renters no matter their landlord.

MY NEXT CREDIT STEPS

It’s been 13 months since I started constructing my credit score rating, and it hasn’t value me a cent.

Now my credit score rating is 740, the one issue negatively affecting my rating is my lack of credit score historical past.

The common credit score rating (for individuals who have one) is 714, in keeping with Experian.

I’ve paid no curiosity or charges as a result of I used my bank cards sparingly and at all times paid off the complete steadiness.

I’ll be trying to take out one other bank card quickly so I can reap the benefits of extra rewards, and proceed constructing my rating with on-time funds.

WHAT TO LOOK FOR IN A CREDIT CARD

If you’re trying to apply for a bank card, there are a number of components to contemplate.

First is your eligibility, as sure playing cards require a sure credit score rating to turn out to be a card-holder.

Don’t apply for playing cards that you just don’t have a excessive likelihood of being accepted for, as a denied utility can have a detrimental influence in your rating.

Use a web based eligibility checker first – there are a number of free instruments accessible on-line.

You can even monitor your credit score rating utilizing Credit score Karma, Experian, or WalletHub.

Subsequent, contemplate the APR (annual proportion price) of a bank card earlier than making use of.

The APR displays how a lot curiosity you may be charged on any steadiness that’s not paid off each month.

For instance, when you have a $100 steadiness on a card with a 20 % APR, that may value you $120 to repay in the event you depart it there for a 12 months.

It’s best to pay your card off in full each month, however in the event you can’t, a low APR will value you much less.

Additionally it is crucial to grasp what card-holder charges apply.

Some playing cards with high-tier rewards applications resembling an American Categorical cost a payment that may go as excessive as $695.

When making use of in your first one or two bank cards, there are many free choices accessible.

For extra private finance ideas, take a look at three renter-friendly upgrades to carry your vitality payments down.

And see the main change Walmart is making to its bank card partnership with Capital One.